michigan gas tax rate

Compressed Natural Gas CNG 0184 per gallon. Gas Natural Gas Liquids Condensate.

Arizona Sales Tax Small Business Guide Truic

Prepaid GasolineDiesel Fuel Rates - July 2022 Effective July 1 2022 the State of Michigan has updated the prepaid gasoline and diesel fuel.

. Per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. 26 rows Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale. Michigan Business Tax 2019 MBT Forms 2020 MBT Forms.

4 of gross cash market value. The current federal motor fuel tax rates are. Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022.

Motor Fuel Tax The state of Michigan imposes a 19-cent per gallon excise tax on gasoline used in motor vehicles. 2022 Michigan state sales tax. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground.

Diesel Fuel 263 per. The measure would ensure the state temporarily stopped collecting the 6 sales or use taxes on gas and the per-gallon gas tax from mid-June through mid-September. Michigan House lawmakers approved a Republican-backed plan 63-39 Wednesday to suspend the states 272 cent-per-gallon gas tax for six months a move aimed to provide.

Lawmakers have faced pressure to rescind Michigans 27-cent-per-gallon tax rate on all types of fuel as gas prices have soared in recent months. For fuel purchased January 1 2017 and through December 31 2021. The Michigan state sales tax rate is 6 and the average MI sales tax after local surtaxes is 6.

The same three taxes are included. MI Sales Tax Express Program Subject. Didnt gas taxes just go up.

Prepaid Fuel Sales Tax Rates. Was 3102 cents while the federal gas tax rate was 184 cents. That includes a roughly 1-cent automatic increase to the.

This tax is established in the Motor Fuel Tax Act 2000 PA 403. 1 2017 as a result of the 2015 legislation. It will remain in place until at least the end of the year.

29 rows Gasoline is 247 cents per gallon. Notice Concerning Inflation Adjusted Fuel Tax Act and Applicable to IFTA Motor Carriers That Will Take Effect on January. Exact tax amount may vary for different items.

Fund 027 Michigan Sales Tax 024 School Aid Fund 018. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as California Hawaii Illinois and Nevada. Diesel is 311 cents per gallon.

Motor Fuel Tax Mi. The tax on regular fuel increased 73 cents per gallon and the. Michigan fuel taxes last increased on Jan.

What is Michigans gas tax now. Crude Oil 231 Refining 059 DistributionMarketing 064 Federal Motor Fuel Tax 018 Mi. An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon.

0219 gallon Most jet fuel that is. As of January 2022 the average state gas tax in the US. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation. View the Current Notice of. 2015 an out-of-state seller may be required to.

66 of gross cash market value. Gasoline 263 per gallon.

Highest Gas Tax In The U S By State 2022 Statista

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

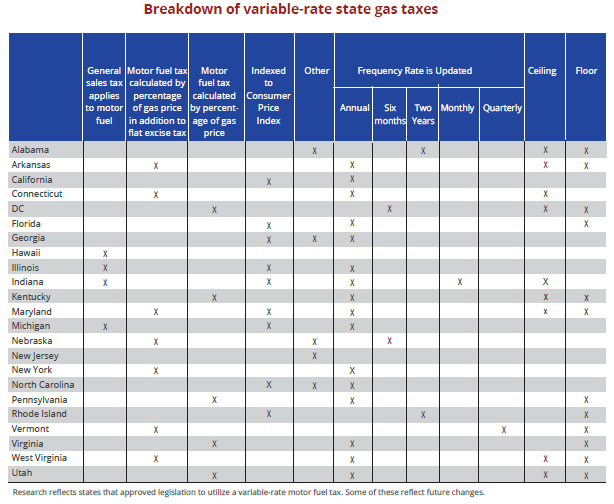

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Highest Gas Tax In The U S By State 2022 Statista

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Michigan S Gas Tax How Much Is On A Gallon Of Gas

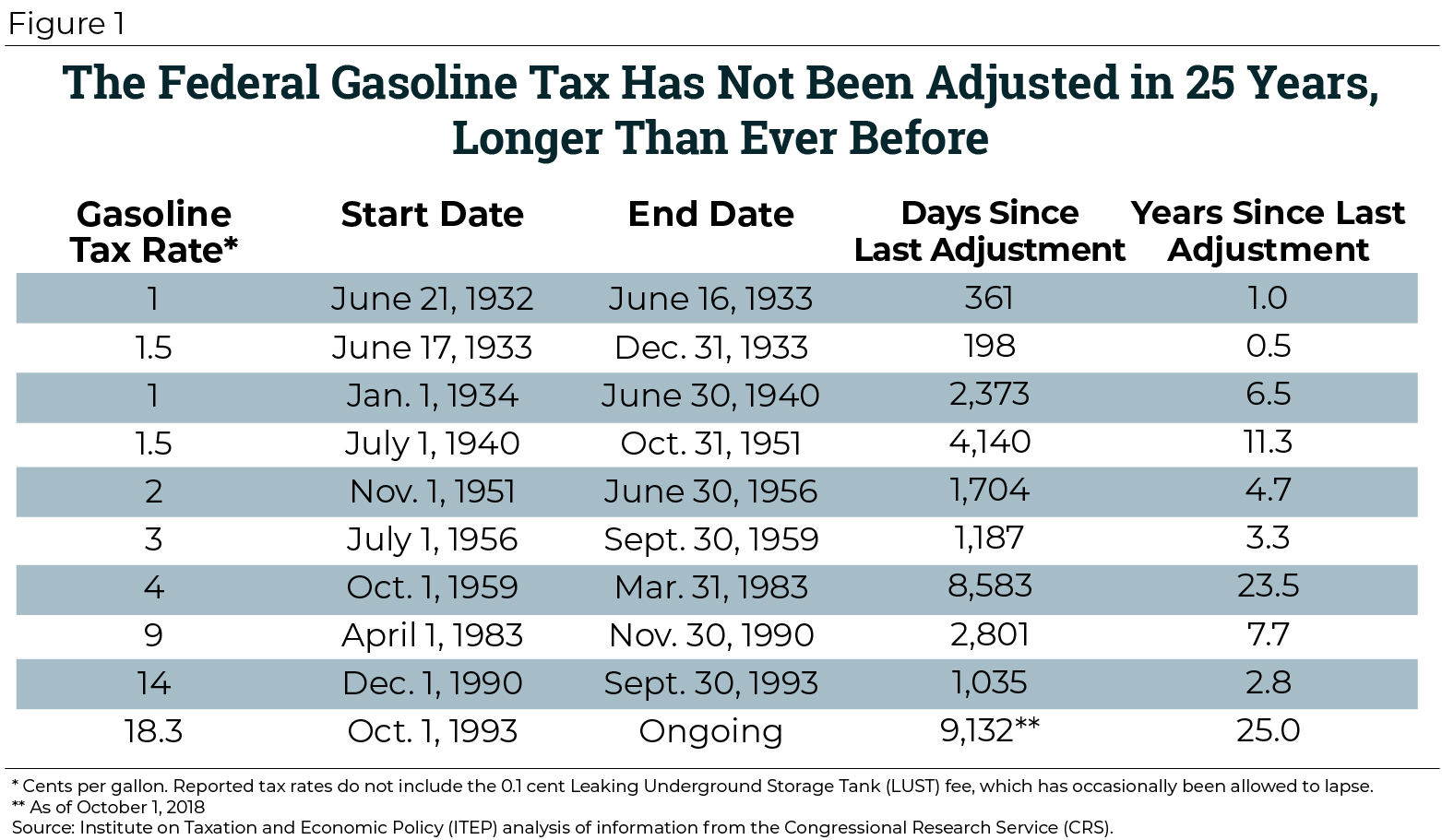

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Most Americans Live In States With Variable Rate Gas Taxes Itep

Sales Tax On Grocery Items Taxjar

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep