income tax calculator indonesia

Employment income in Indonesia is subject. See California Texas Florida New York Pennsylvania etc.

How To Calculate Income Tax In Excel

A company may use the reduced income tax rate in Indonesia initially for three years.

. For fiscal year 20202021 the CIT rate is 22 and for the year 2022 onwards the CIT rate will be 20. Corporate income tax CIT due dates. The Tax tables below include the tax rates thresholds and allowances included in the Indonesia Tax Calculator 2020.

TOTAL VALUE IN IDR Total Value in USD Total CIF x IDR exchange rate. Indonesia Income Tax Calculator How To Do It In this article we will go over the main taxes companies and individuals need to report and how to do it if you are not physically in IndonesiaTo register online individuals and companies must register an online tax file number EFIN. Generally the VAT rate is 10 percent in Indonesia.

United States Sales Tax. Income Tax PPh. A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs.

Point 13 multiplied by 12. Resident taxpayers must file personal income tax returns through a self-assessment system and are subject to tax rates of 5 to 30. Personal Income Tax Rate Rp An extra 20 is levied on people who do not have a tax number NPWP on top of progressive income tax rates above.

Apakah Anda memiliki NPWP Bagian ini diisi dengan NPWP sesuai dengan yang tercantum pada Kartu Nomor Pokok Wajib Pajak Kartu NPWP. Import Duty BM. Annual Tax Exempt Income.

There is base sales tax by most of the states. Tax payable progressive rates 139225144. An extra 20 is levied on people who do not have a tax number NPWP on top of progressive income tax rates above.

To calculate the total import tax you will first need to convert the total value of the goods to Indonesian Rupiah using the following formula. Counties cities and districts impose their own local taxes. Total value x percentage of import duty.

For resident taxpayers the income tax system in Japan is a progressive tax system. Deductions for an individual are Rp. Sales Tax in US varies by location.

In Indonesia a general flat rate of 25 applies becoming 22 in 2020. Total value Import Duty x percentage of Income Tax. Calculate in advance or ask advice from your tax consultant to see which rate would be most suitable for your business.

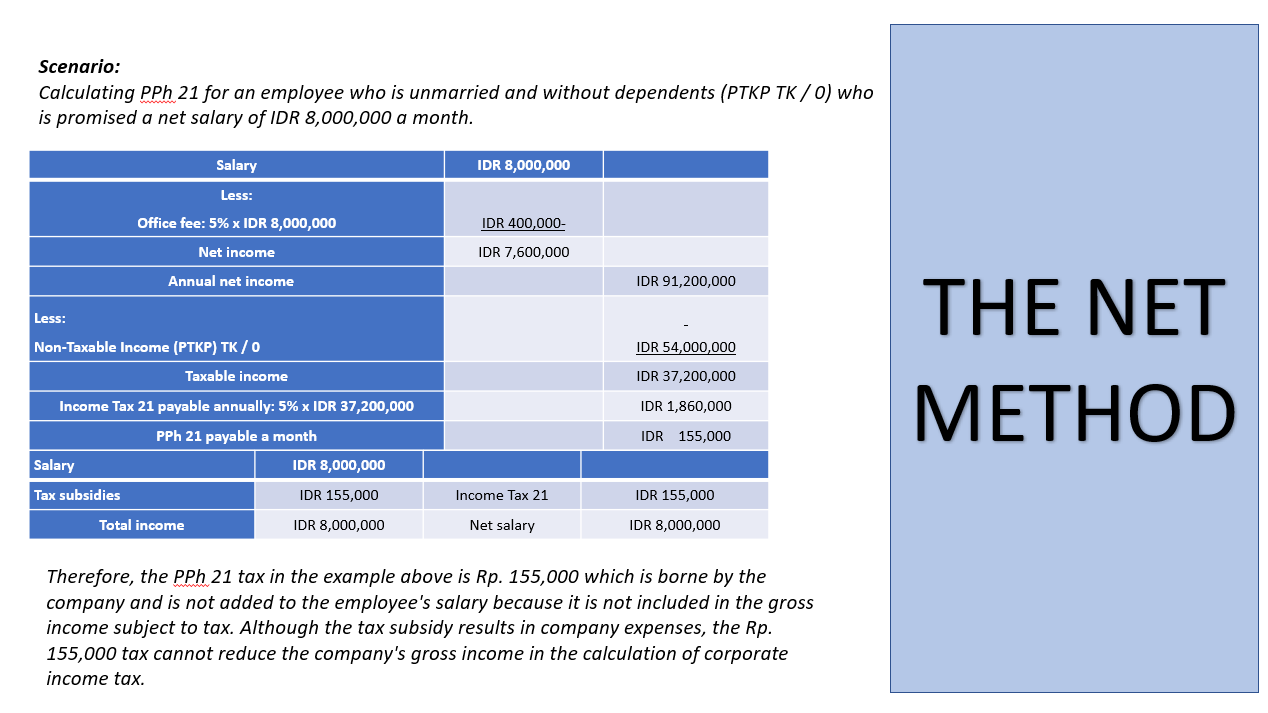

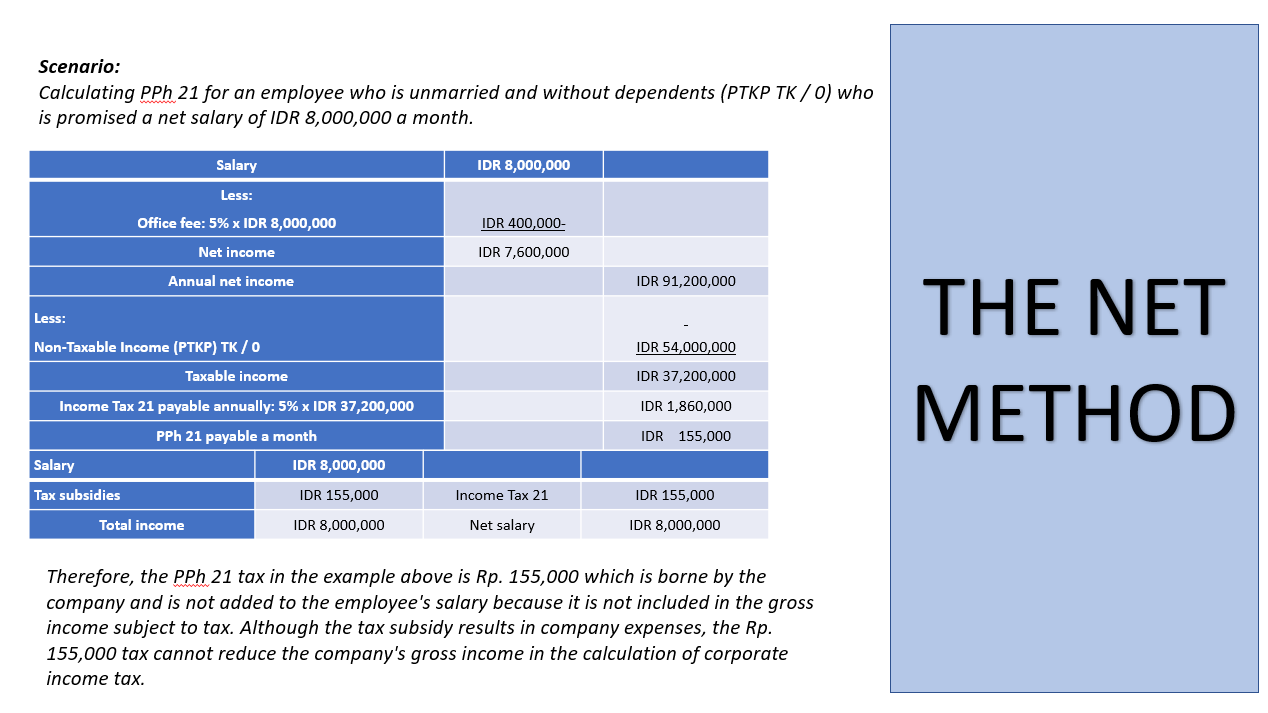

It can be a little complicated because you first need to know the HS code and search it to. Indonesian tax resident companies and permanent establishments are required to withhold income tax Article 21 Income Tax from the salaries payable to their employees as individual resident taxpayers monthly basis and pay the tax to the State Treasury on their behalf and then report to the Tax Office. Deductions for an individual are Rp 2880000 wife 2880000 and up to three children Rp 1440000.

Public companies that have a minimum listing requirement of 40 and other specific conditions are eligible to a 3 cut off from the. Corporate income tax CIT rates. Total Annual Net Income.

If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the year 2015 your tax exempt income becomes Rp 45000000. This field is adjusted toward your status Eg. The corporate income tax CIT rate in Indonesia is 25.

Total value Import Duty x 10. Taxable income in Indonesia. The Income tax rates and personal allowances in Indonesia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

2880000 wife 2880000 and up to three children Rp. How to calculate the total cost of import in Indonesia. Example of a standard personal income tax calculation in Indonesia Worldwide Tax Summaries.

Position Expense Biaya Jabatan is a deduction with a maximum 5 from gross income or a maximum of Rp 1296000. Corporate Income Tax Rate. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. However the exact rate may be increased or decreased to 15 percent or 5 percent according to government regulation. Corporate income tax rate of Indonesian companies.

For 2022 tax year. However the Omnibus Law has added a provision to the Income Tax Law stipulating that foreigners who have become domestic tax subjects by reason of becoming tax resident in Indonesia can be taxed only on. How to calculate import taxes simulation in Indonesia.

Bagi penerima penghasilan yang dipotong PPh Pasal 21 yang tidak memiliki NPWP dikenakan PPh Pasal 21 dengan tarif lebih tinggi 20 daripada. If you reach the gross income limit IDR 48 billion per year during this time you must stop using the reduced income tax rate. Dealing with Income tax in Indonesia is quite troublesome especially if your company has a lot of employee.

Tax rates range from 5 to 45. However if your company is a public company that satisfy the minimum listing requirement of 40 in. Deductions for an individual are Rp.

Calculate United States Sales Tax. Annual PPh 21 Tax. All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. VAT on the export of taxable tangible and intangible goods as well as export of services is fixed at 0 percent. 2880000 wife 2880000 and up to three children Rp.

The personal income taxpayer can be a resident or a non-resident of Indonesia. CIF Freight on Board Insurance Freight Cost x exchange rate.

Indonesia Payroll And Tax Guide

How To Calculate Income Tax In Excel

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Indonesia Salary Calculator 2022 23

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Singapore Income Tax Calculator Corporateguide Singapore

![]()

Indonesia Salary Calculator 2022 With Income Tax Brackets Investomatica

How To Calculate Income Tax In Excel

Indonesia Payroll And Tax Guide

How To Calculate Income Tax In Excel

Indonesia Salary Calculator 2022 With Income Tax Brackets Investomatica

Personal Income Tax Pit In Indonesia Acclime Indonesia

How To Calculate Foreigner S Income Tax In China China Admissions

Personal Income Tax Pit In Indonesia Acclime Indonesia

How To Calculate Income Tax In Excel

Indonesia Income Tax Rates For 2022 Activpayroll